What Is Cryptocurrency Staking?

You may think of staking as a less resource intensive alternative to mining. It involves holding funds in a crypto wallet to support the security and operations of a blockchain network. Simply put, staking is the act of locking your cryptocurrencies to receive rewards. In most cases you’ll be able to stake your coins directly from your cryptocurrency wallet, such as Trust Wallet. On the other hand, many exchanges offer staking services to their users. Binance lets you earn rewards in an very simple way. All you have to do is hold your coins on the exchange. To get a better grasp of what cryptocurrency staking is, you’ll first need to understand how Proof-of-Stake (PoS) works. PoS is a consensus mechanism that allows blockchains to operate more energy-efficiently while maintaining a decent degree of decentralization (at least in theory).

How does crypto staking work?

Proof of Stake chains produce and validate new blocks through the process of staking. Staking involves validators who lock up their coins so they can be randomly selected by the protocol at specific intervals to create a new block. Participants that stake larger amounts have a higher chance of being chosen as the next block validator. This allows for blocks to be produced without relying on mining hardware like ASICs. While ASIC mining requires a significant investment in the hardware, staking requires a direct investment in the cryptocurrency itself. Instead of competing for the next block with other hardware mining rigs, PoS validators are selected based on the number of coins they are staking. The “stake” (the amount of coins) is what incentivizes validators to maintain network security. If they fail to do that, their entire stake might be at risk.

How are staking rewards calculated?

There is no short answer here. Each blockchain network may use a different way of calculating the staking rewards.

Some are adjusted on a block by block basis, taking into account many different factors. These can include:

- how many coins the validator is staking

- how long the validator has been actively staking for

- total amount of coins staked on the network

- the inflation rate

- other factors

For some other networks, staking rewards are determined as a fixed percentage. These rewards are distributed to validators as a sort of compensation for inflation. Inflation encourages users to spend their coins instead of holding them, which may increase their usage as cryptocurrency. But with this model, validators can calculate exactly what staking reward they can expect.A predictable reward schedule rather than a probabilistic chance of receiving a block reward may look favorable to some. And since this is public information, it might incentivize more participants to get involved in staking.

How to stake on Binance?

Staking on the Binance exchange is very straightforward:

- Binance. Head over to the Binance homepage and create a Binance account.

- Deposit. Deposit the cryptocurrency you wanna stake into the Binance wallet or purchase BNB tokens via fiat or crypto exchange. (You should check that Binance offers staking for that specific coin first)

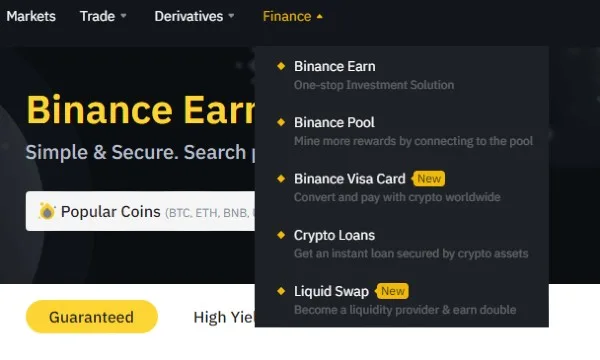

- Binance Earn. Navigate to the Binance Earn page. This can be accessed via the dropdown menu: Finance > Binance Earn.

- Search For The Coin. Search for the coin in the coin search box (i will be using Cardano (ADA) as an example).

- Product selection. Look for the “Staking” product in the available list and click “Stake” at the end of the row.

- Locking period. Choose your locking period (14, 30, 60 or 90 days) and the amount you would like to stake. The minimum and maximum amount of coins you can stake is different for each coin.

- Confirm. Once you have accepted the staking agreement, you will then need to confirm your transaction. That’s it! You will now start passively earning Binance Coin rewards. At the time of writing, the estimated annual percentage yield (APY) for ADA is 7.79%, but this changes on a daily basis.

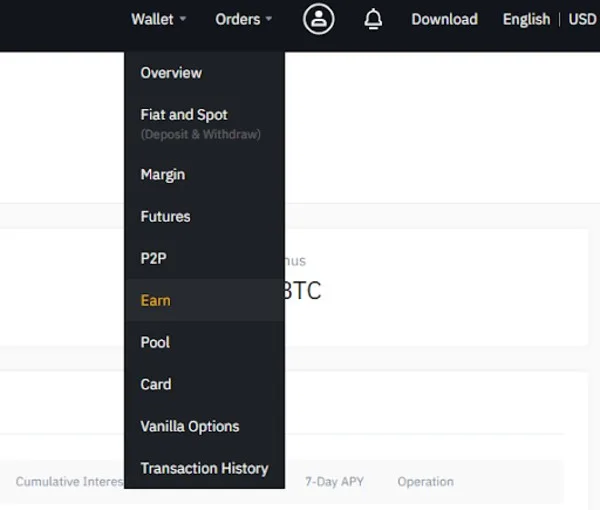

Staked coins can be withdrawn or traded at any time by clicking “Redeem earlier” after navigating to your staked orders. This can be accessed via Wallet > Earn. (IMPORTANT: This will make you lose all the staking rewards gained from that locked staking. Example: So let’s say i staked 1000 ADA and did it for 10 days and earned 5 ADA, but then i really needed those 1000 ADA i had on locked staking for 60 days, so i decided to “redeem eariler”. That would have given me the 1000 ADA back and not 1005 ADA.

How much can I earn from staking Binance coin on Binance?

The amount of interest users receive on staking Binance Coin (BNB) depends on a number of factors:

- The amount of BNB staked by a validator

- The supply and demand of BNB staked on a network (if there is less supply, the rewards will be raised to incentivise extra staking)

- Length of locking period

- Number of BNB tokens delegated

- Commission fees charged by a validator

Delegators that stake Binance Coin (BNB) can expect to earn approximately 9-11% APY (excluding commission and gas fees) based on Binance’s Fixed Staking option. In comparison, returns from yield farming can vary wildly, ranging from less than 1% to over 100%. Remember though that all these returns are variable, and yield farming is especially volatile and carries additional risks.

Real world earnings will ultimately depend on the market value of the BNB token. If the price of Binance Coin (BNB) rises, rewards will increase proportionally. If the price of Binance Coin drops, it could eat into profits.

One thought on “Cryptocurrency Staking: Is it worth staking on Binance?”